flow-through entity tax form

1 As a result Michigan is the latest state to enact an entity-level tax regime as a workaround to the federal 10000 state and local tax SALT deduction limitation adopted under the Tax Cuts and Jobs Act TCJA of 2017. With flow-through entities the income is taxed only at the owners individual tax rate for ordinary income.

Pass Through Entity Tax 101 Baker Tilly

The flow -through entity tax is levied and imposed on certain electing flow-through entities with business activity in Michigan.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

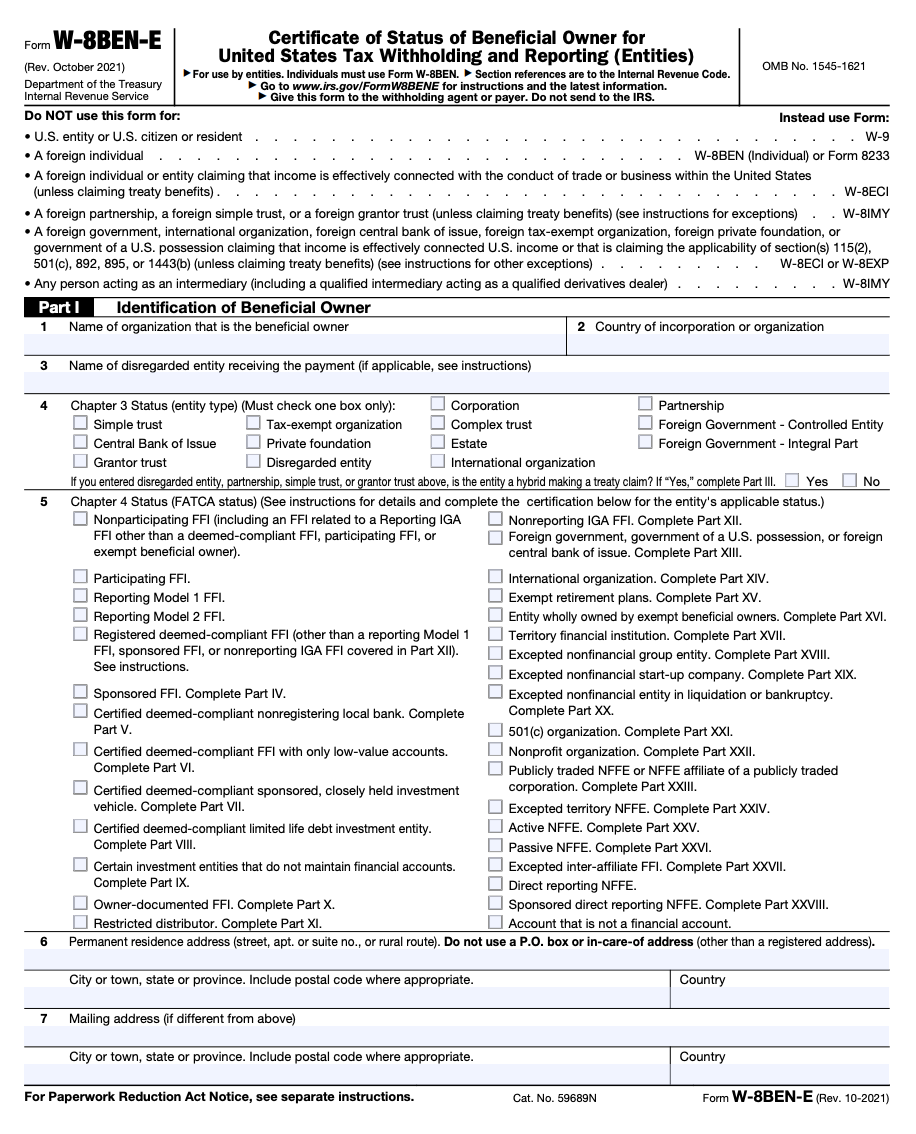

. Section references are to the Internal Revenue Code. Flow-Through Entity FTE Tax Credit. Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

FTE Tax Credit FAQs. On the Form Selection page choose Request for six-month extension to file the pass-through entity tax. Who is eligible to pay the flow-through entity tax.

The information in this section also applies if for the 1994 tax year you filed Form T664 Election to. Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account. FTE Tax Credit FAQ.

T 1 215 814 1743. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. Select the Services menu in the upper-left corner of the Account Summary homepage.

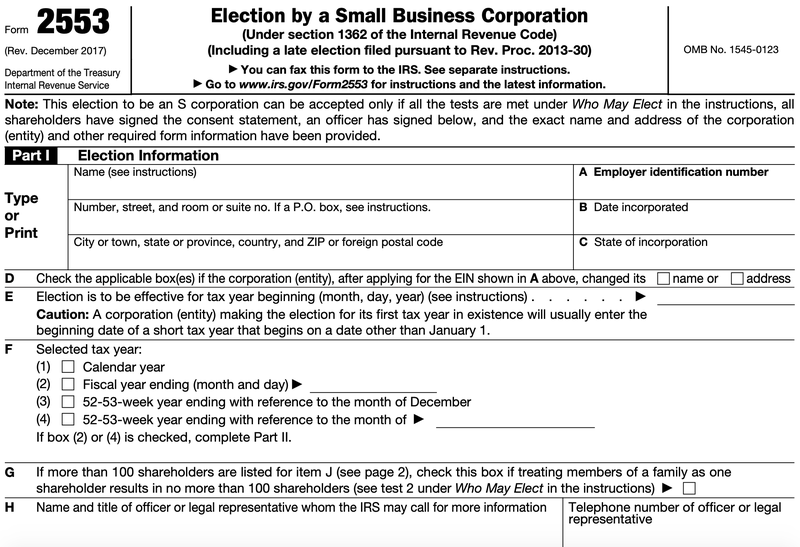

000 Tax Type PAY Tax Amount 9 Flow-Through Entity Tax Select Pay. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. For this purpose aflow -through entity is defined as an S corporation or a partnership under the internal revenue code for federal income tax purposes.

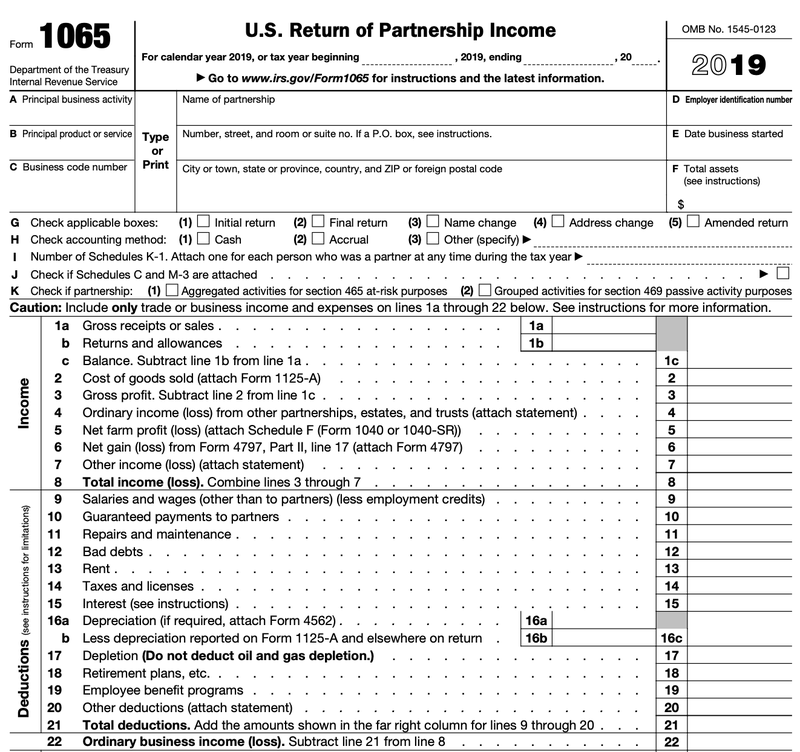

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the equivalent of federal Form 1120 and unlike. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. As signed into law by Governor Whitmer on December 20 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in Michigan.

Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting. Once the payment is made the payment will remain as a PTE elective tax until a tax return.

A Flow-Through Entity Tax Your Payment Select Flow-Through Enti Enter your payment amounts in the Tax Amount Penalty Amount and Interest Amount fields for each tax type below. October 2021 Department of the Treasury Internal Revenue Service. Instructions for 2021 Michigan Flow-Through Entity Annual Return Form 5773.

Instructions for 2021 Schedule for Reporting Member Information for a Flow-Through Entity. LOG IN TO REQUEST EXTENSION. No Matter What Your Tax Situation Is TurboTax Has You Covered.

Instructions for 2021 Schedule for Reporting Non-electing Flow-Through Entity Income Form 5774. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to. If a payment category does not apply leave it blank.

FTE Tax Credit and Michigan IIT Return Form MI-1040 FTE Tax Credit and Michigan Composite IIT Return Form 807 FTE Tax Credit and Michigan Fiduciary IIT Return Form MI-1041 Follow us. Due to the unique combination of factors related to the implementation of the tax including its enactment late in 2021 its retroactive application effective January 1 2021 and its immediate estimated tax. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

Represent that a foreign person is a qualified intermediary or nonqualified. Fiscal year flow-through entities elected into the tax will pay quarterly estimated tax on due dates determined in accordance with that entitys fiscal year. Flow-through entities are a common device used to avoid double taxation on earnings.

Entities can also use the Pass-Through Entity Elective Tax Payment Voucher FTB 3893 to make a PTE elective tax payment by printing the voucher from FTBs website and mailing it to FTB. General FTE Tax Credit. The Michigan Flow-through Entity Tax is administered under the provisions of the Revenue Act which permits a compromise of interest or penalties or both.

Select Corporation tax or Partnership tax then choose PTET web file from the expanded menu. Branches for United States Tax Withholding and related Instructions is used by foreign intermediaries and foreign flow-through entities as well as certain US. As signed into law by Governor Whitmer on December 20 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in Michigan.

Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to. Gretchen Whitmer signed legislation on Dec.

Click the payment button to initiate the payment. Branches for United States Tax Withholding and Reporting. 20 2021 to provide an elective flow-through entity FTE tax.

Finally due to the nature of this retroactive application to 2021 tax situations quarterly estimated payments of tax otherwise due for tax year beginning in 2021 will not accrue any penalty or interest.

Elective Pass Through Entity Tax Wolters Kluwer

What Is A Pass Through Entity Definition Meaning Example

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

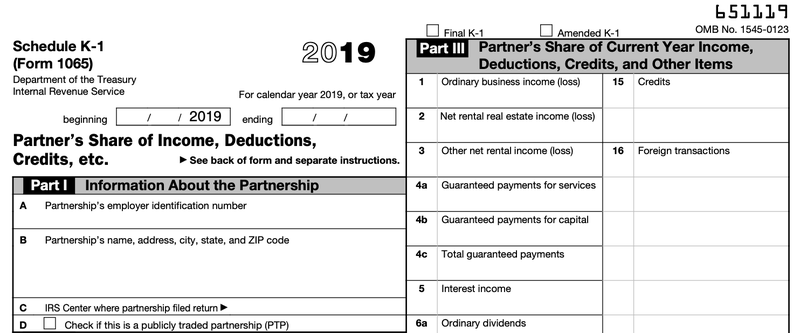

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

4 Steps To Filing Your Partnership Taxes The Blueprint

4 Types Of Business Structures And Their Tax Implications Netsuite

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

How To Fill In W 8ben W 8ben E Form Deel

Pass Through Income Meaning Example Investinganswers

Pass Through Entity Definition Examples Advantages Disadvantages

An Overview Of Pass Through Businesses In The United States Tax Foundation

Pass Through Entity Definition Examples Advantages Disadvantages

4 Steps To Filing Your Partnership Taxes The Blueprint

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

Understanding The 1065 Form Scalefactor